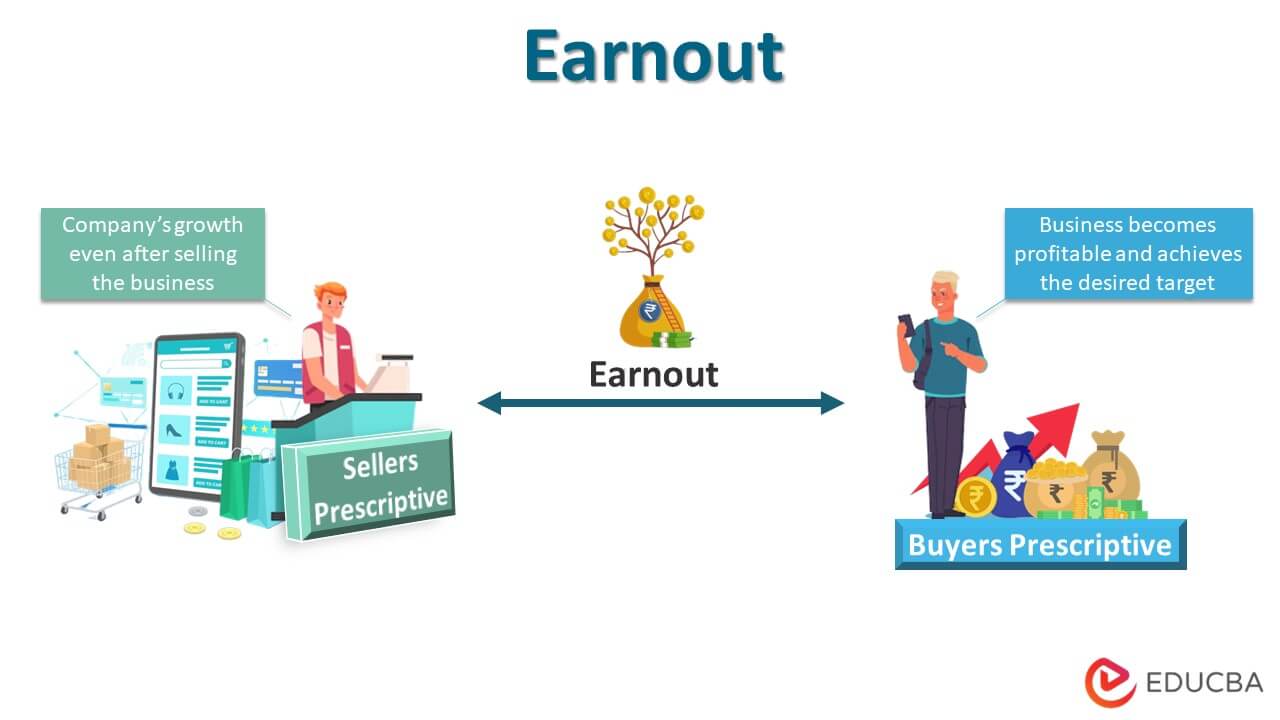

Earnout Basics

An earnout is a transaction mechanism where the buyer agrees to pay additional consideration to the seller post-closing that is contingent on the target’s future performance, milestones, or events. Earnouts serve several crucial purposes in M&A deals:

- Bridges Valuation Gaps: They help reconcile differing valuations of a target company between buyer and seller.

- Seller/Management Incentivization: They incentivize sellers and management teams to maximize post-closing performance.

- Growth Potential: They are often used for young targets with significant growth potential or when increased profitability is anticipated due to external factors (e.g., new laws, technological advancements).

- Economic Volatility: They are particularly useful when a purchase is made during volatile economic periods.

Key Terms in Earnout Negotiations

Several critical terms must be decided upon when negotiating an earnout to ensure clarity and enforceability:

- Performance Metric, Milestone, or Event Occurrence: The majority of these metrics relate to revenue, EBITDA, or earnings.

- Buyer Preference: Buyer prefers a performance metric that is towards the bottom of an income statement (e.g., net income or EBITDA).

- Seller Preference: Seller prefers a performance metric that is towards the top of an income statement (e.g., revenue).

- Calculation: Can be a fixed fee or a graduated formula.

- Duration: The period over which the earnout metrics are measured.

- Information Rights: Specifies the seller’s access to information regarding the target’s performance.

- Economics: Includes floors (minimum payments) and caps (maximum payments).

- Offset Rights on Indemnification Claims: Allows the buyer to offset earnout payments against indemnification claims.

- Governing Jurisdiction: Determines the applicable law for the earnout agreement.

- Acceleration/Termination: Provisions for when the entire earnout might be paid or the right to receive earnouts terminated due to events like a change of control.

- Post-Closing Covenants: Obligations placed on the buyer to support the earnout, such as:

- “Reasonable efforts to achieve performance metrics.”

- Ensuring “Operations shall be consistent with past practices.”

- Providing information rights and ongoing support.

- Dispute Resolution: Mechanisms like “Arbitration, mediation, independent accounting firm,” for resolving potential disagreements.

Pros and Cons of Earnouts

Earnouts can offer both advantages and disadvantages for both parties. Here are some pros:

- Higher/Discounted Purchase Price: Possibility of higher purchase price for seller… and a discounted purchase price for buyer.

- Completes Transactions: Assists in completing a transaction where parties cannot agree on purchase price.

- Cash Management for Buyer: Deferred payments allow buyer to hold cash and possibly use revenue from target to pay for the earnout.

- Incentivization: Can incentivize seller/management to maximize profitability of target.

Here are some cons:

- Uncertain Purchase Price: Possibility of lower purchase price for seller and a higher purchase price for buyer.

- Increased Costs and Obligations: Increase in legal fees and post-closing obligations.

- Loss of Seller Influence: Seller usually loses influence on outcome of target operations.

- High Litigation Risk: Earnouts are particularly litigious.

Earnout Disputes and Litigation Risks

Earnouts frequently lead to disputes, which commonly stem from initial disagreements over valuation and payout calculations, timing, and methodology.

- Reality: While they aim to resolve disputes thought contractual language, the risk is that earnout merely defers and does not solve a dispute. As a Delaware court wrote many years ago, earnouts can “merely convert today’s dispute over price into tomorrow’s litigation over the outcome.”

- Likelihood of Litigation: Litigation is most likely when:

- Post-closing performance does not match seller’s expectations

- Earnout potential represents material part of consideration

- Payment amount is uncertain or disputed.

Most Common Issues in Dispute

- Binding Obligation: Vague earnout structures can be challenged as “too uncertain or indefinite to be enforced” or as an “agreement to agree.”

- Calculation of Payment: Ambiguous formulas, risk of manipulation, and undefined terms like “revenue” or “profit” lead to disagreements.

- Buyer’s Management of Business: Buyers prioritizing long-term growth over short-term earnout targets, even with covenants for “consistent with practices,” can be a source of conflict.

- Standards to Protect Earnout: Clauses requiring “best efforts” to maximize earnout may be unenforceable without “more definite standards.” Prohibitions against buyer actions that decrease earnout must be “specific.”

- Good Faith and Fair Dealing Claims: While this serves as a “gap filler” in narrow instances it must not be forgotten. But each state is different on this point: this duty is not implied when Texas law applies.

Dispute Resolution Provisions

Due to the litigious nature of earnouts and public interest in “juicy” disputes, parties often include specific dispute resolution provisions to keep disagreements out of court. Please read this post to learn more about this topic: Effective Use of Arbitration Clauses – Seidman Law

In total, business transactions need experienced business transaction professionals including attorneys.

David Seidman is the principal and founder of Seidman Law Group, LLC. He serves as outside general counsel for companies, which requires him to consider a diverse range of corporate, dispute resolution and avoidance, contract drafting and negotiation, real estate, and other issues. He can be reached at david@seidmanlawgroup.com or 312-399-7390.

This blog post is not legal advice. Please consult an experienced attorney to assist with your legal issues.

Photo Credit: EDUCBA